When the Trump administration unveiled its budget proposal, it sparked a firestorm of debate, especially around the concept of "Trump Budget: Aid for Rich." Many critics argue that the plan disproportionately benefits wealthy individuals and corporations, while others claim it's a necessary step to boost economic growth. But what exactly is this budget all about, and how does it impact different segments of society? Let's dive in and break it down.

Picture this: You're sitting in your living room, scrolling through the news, and suddenly you come across headlines screaming about the Trump administration's budget proposal. The phrase "aid for rich" keeps popping up, and you're left wondering, "What's really going on here?" Well, buckle up because we're about to unravel the complexities of this controversial plan.

This article isn't just another regurgitation of facts; it's a detailed exploration of the Trump budget proposal, focusing on how it allegedly aids the wealthy. We'll dissect the numbers, examine the policies, and explore the potential consequences for both the rich and the not-so-rich. So, whether you're a policy wonk or just someone curious about the state of our economy, this piece is for you.

Read also:Discovering The Remarkable Journey Of Byron Allen A Visionary In Entertainment

Understanding the Trump Budget Proposal

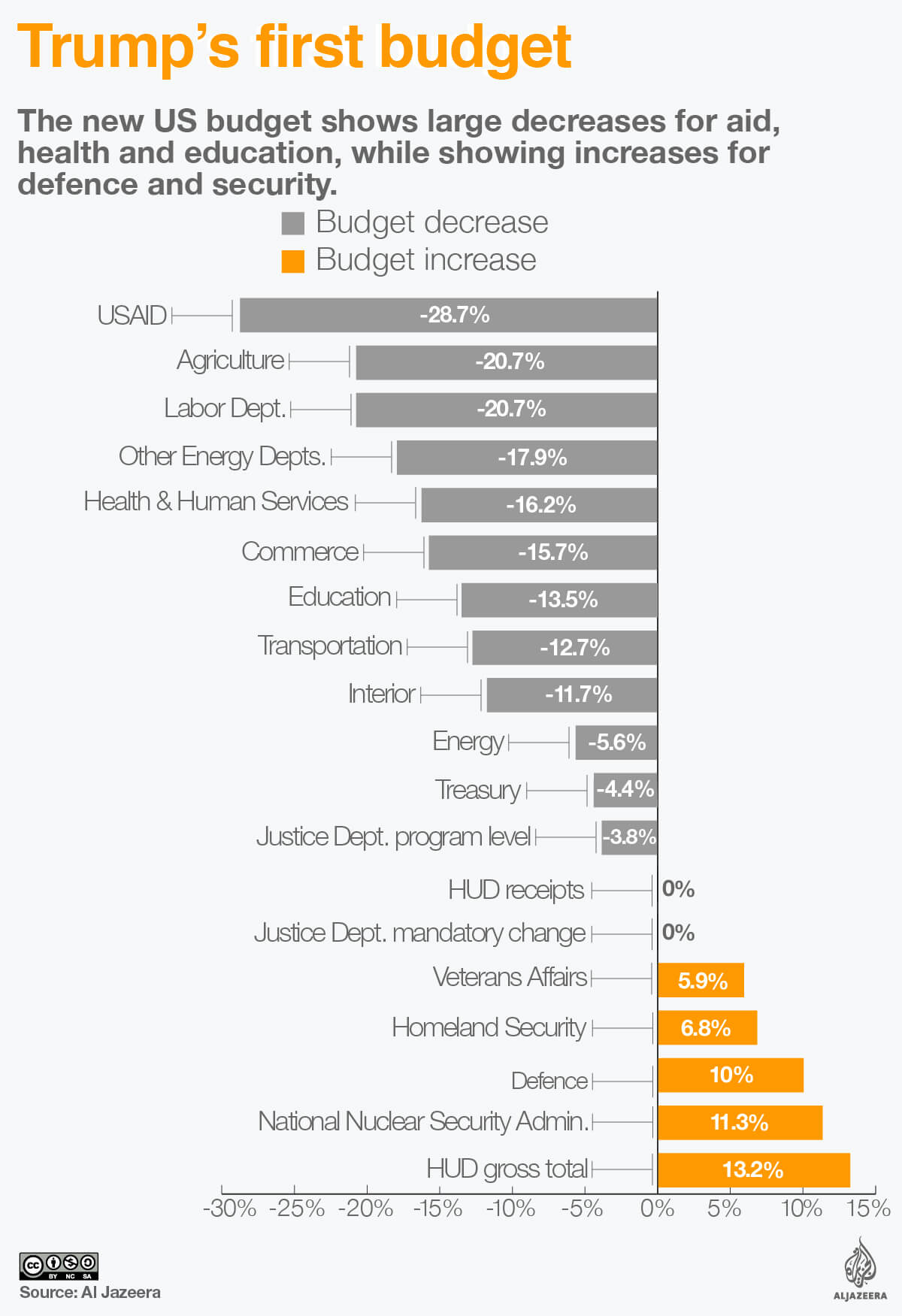

Before we dive headfirst into the "aid for rich" aspect, let's take a moment to understand the broader context of the Trump budget proposal. Announced in 2017, this plan aimed to reshape the fiscal landscape of the United States. It included significant tax cuts, increased military spending, and cuts to social programs. But why did it raise so many eyebrows? Let's break it down.

Key Features of the Budget

Here are some of the standout features of the Trump budget:

- Tax cuts for corporations and high-income individuals.

- A boost in defense spending by a whopping $54 billion.

- Cuts to domestic programs like Medicaid, food stamps, and environmental protection.

- Reduction in foreign aid and international development funds.

These measures were designed to stimulate economic growth, but they also raised concerns about widening income inequality. Critics argue that the benefits of these policies primarily flow to the wealthiest segments of society, leaving the middle and lower classes behind.

Trump Budget: Aid for Rich – The Controversy

Now, let's zoom in on the elephant in the room: the accusation that the Trump budget disproportionately aids the rich. This claim is rooted in several key aspects of the proposal, particularly the tax cuts and spending priorities.

Breaking Down the Tax Cuts

The tax cuts proposed in the Trump budget were nothing short of massive. Here's how they played out:

- Corporations saw their tax rate slashed from 35% to 21%.

- High-income individuals benefited from reduced tax brackets and lower rates on capital gains.

- Estate taxes were relaxed, allowing wealthier families to pass on larger inheritances tax-free.

While proponents argue that these cuts would trickle down to the middle class by encouraging business investment, critics point out that the immediate beneficiaries are the wealthiest Americans. Studies by organizations like the Tax Policy Center suggest that the top 1% of earners would see the largest percentage increase in after-tax income.

Read also:Tesla Defaced With Swastika Shocks Owner The Incident That Sparked Global Outrage

Impact on Wealth Inequality

One of the most hotly debated aspects of the Trump budget is its potential impact on wealth inequality. By providing significant tax breaks to the rich, the plan risks exacerbating the gap between the haves and have-nots. Let's explore this in more detail.

Numbers Don't Lie

According to data from the Congressional Budget Office (CBO), the tax cuts in the Trump budget would result in the following:

- By 2027, the top 1% of earners would receive an average tax cut of $65,000.

- Meanwhile, the middle 20% of earners would see an average tax cut of just $930.

- The bottom 20% would receive an average tax cut of $60.

These numbers highlight the disparity in how the benefits of the tax cuts are distributed. While the wealthy see substantial gains, the middle and lower classes receive comparatively modest relief.

Defense Spending vs. Social Programs

Another contentious element of the Trump budget is the emphasis on defense spending at the expense of social programs. This shift in priorities has sparked heated debates about the role of government in addressing societal needs.

A Closer Look at the Numbers

Here's a breakdown of the proposed spending changes:

- Defense spending increased by $54 billion.

- Medicaid funding was cut by $800 billion over ten years.

- Food stamp programs faced reductions of $193 billion.

- Environmental protection budgets were slashed by 31%.

Supporters argue that a strong defense is crucial for national security, while critics contend that cutting social programs will harm vulnerable populations and deepen inequality.

Public Reaction and Expert Opinions

The Trump budget proposal didn't just spark debates among politicians; it also generated strong reactions from the public and experts alike. Let's take a look at what they had to say.

What the Experts Say

Economists and policy analysts offered varying perspectives on the budget:

- Some praised the tax cuts for their potential to stimulate economic growth.

- Others warned of the long-term fiscal implications, including increased national debt.

- Many expressed concerns about the social impacts of cutting vital programs.

For instance, a report by the Center on Budget and Policy Priorities highlighted how the proposed cuts to Medicaid could leave millions without access to healthcare. Meanwhile, advocates for the plan argued that a stronger economy would eventually benefit everyone.

International Implications

While much of the focus has been on domestic impacts, the Trump budget also has significant international ramifications. Reduced foreign aid and changes in trade policy have raised eyebrows around the globe.

Global Perspectives

Here's how the world reacted:

- Developing nations expressed concern over reduced U.S. aid.

- Trade partners worried about the potential for increased tariffs.

- Environmental groups criticized the rollback of international climate commitments.

These reactions underscore the interconnected nature of global economics and politics, highlighting how domestic budget decisions can have far-reaching consequences.

Long-Term Outlook

As we look to the future, the long-term effects of the Trump budget remain uncertain. Will the tax cuts spur sustained economic growth, or will they lead to deeper inequality and fiscal challenges? Only time will tell.

Predictions and Possibilities

Experts offer the following predictions:

- The tax cuts could lead to short-term economic boosts but may result in higher deficits over time.

- Reduced social spending might strain safety nets, affecting vulnerable populations.

- Changes in international policy could reshape global alliances and economic partnerships.

These possibilities highlight the complex interplay of fiscal, social, and geopolitical factors that will shape the nation's future.

Conclusion

In conclusion, the Trump budget proposal, particularly its "aid for rich" components, remains a polarizing topic. While proponents argue that it will stimulate economic growth, critics warn of widening inequality and reduced social support. As we've explored, the plan's impact spans a wide range of issues, from tax policy to defense spending to international relations.

So, what can you do? Start by staying informed and engaging in conversations about these critical issues. Share this article with your friends and family to spread awareness. And if you're inspired to learn more, check out our other articles on economics and policy. Together, we can work toward a more equitable and prosperous future.

Table of Contents

Trump Budget: Aid for Rich – A Deep Dive Into the Controversial Plan

Understanding the Trump Budget Proposal

Trump Budget: Aid for Rich – The Controversy

Defense Spending vs. Social Programs