Buying a home is one of life's biggest milestones, but financing it can feel like navigating a maze. If you're exploring Chase Mortgage, you've come to the right place. This guide will walk you through everything you need to know about Chase's mortgage options, helping you make informed decisions for your dream home. Whether you're a first-time buyer or looking to refinance, we’ve got you covered. So, let’s dive in and unravel the world of Chase Mortgage!

Let’s be real, buying a house is no small feat. It’s not just about finding the perfect location or the ideal number of bedrooms. It’s about securing the right financing. And that’s where Chase Mortgage steps in. With a range of options tailored to different needs, Chase aims to simplify the home-buying process. But with so many choices out there, how do you know if Chase is the right fit for you?

We’re here to break it down for you. This guide isn’t just another article filled with jargon. It’s a practical, no-nonsense look at Chase Mortgage, designed to help you understand what they offer, how it works, and whether it aligns with your financial goals. So, grab a coffee, sit back, and let’s explore the ins and outs of Chase Mortgage together.

Read also:Chip And Joanna Gaines Devastating Announcement A Comprehensive Look

Understanding Chase Mortgage: The Basics

Before we dive deep into the nitty-gritty, let’s start with the basics. Chase Mortgage is part of JPMorgan Chase, one of the largest financial institutions in the world. They’ve been in the business of helping people buy homes for decades, and their experience shows. But what exactly does Chase Mortgage offer?

Types of Mortgage Options Available

Chase provides a variety of mortgage options to cater to different buyer profiles. Here are some of the most popular choices:

- Fixed-Rate Mortgages: These come with a set interest rate for the entire loan term, making budgeting easier.

- Adjustable-Rate Mortgages (ARMs): These have variable rates that can change over time, offering flexibility but with some risk.

- FHA Loans: Ideal for first-time buyers, these loans require lower down payments and are insured by the Federal Housing Administration.

- Veterans Affairs (VA) Loans: Designed for eligible military veterans and service members, these loans often come with no down payment requirement.

- USDA Loans: Tailored for rural homebuyers, these loans offer low interest rates and no down payment requirements.

No matter your financial situation, Chase Mortgage likely has an option that fits your needs. But how do you decide which one is best for you? Let’s explore further.

Why Choose Chase Mortgage?

Now that we know what Chase Mortgage offers, let’s talk about why you might want to choose them over other lenders. It’s not just about the mortgage options; it’s about the overall experience. Here are a few reasons Chase stands out:

Reputation and Trust

Chase has built a solid reputation over the years. As part of JPMorgan Chase, they bring decades of experience and a commitment to customer satisfaction. Plus, their widespread network of branches makes it easy to get in touch with a mortgage specialist when you need help.

Competitive Rates

One of the biggest draws of Chase Mortgage is their competitive interest rates. They offer some of the lowest rates in the industry, which can save you thousands of dollars over the life of your loan. But don’t just take our word for it—shop around and compare!

Read also:Ohio State Transfers Bold Weight Loss The Remarkable Journey

Customer Support

Buying a home can be stressful, but Chase aims to make the process as smooth as possible. Their customer support team is available to answer your questions and guide you through every step of the way. Whether you’re stuck on paperwork or unsure about a term, they’re there to help.

Eligibility and Requirements

Before you apply for a Chase Mortgage, it’s important to know if you meet the eligibility requirements. Here’s a quick rundown of what you’ll need:

Credit Score

Your credit score plays a big role in determining your eligibility and the interest rate you’ll receive. Chase typically requires a minimum credit score of 620 for conventional loans, though FHA loans may allow lower scores. It’s a good idea to check your credit report beforehand and address any issues.

Down Payment

The amount of your down payment can also affect your eligibility. While some loans, like VA and USDA loans, require no down payment, others may require as much as 20%. The exact amount depends on the type of loan and your financial situation.

Debt-to-Income Ratio

Your debt-to-income ratio (DTI) is another key factor. Chase generally looks for a DTI of 43% or lower, though exceptions may be made in certain cases. To calculate your DTI, divide your monthly debt payments by your gross monthly income.

Applying for a Chase Mortgage

Ready to apply? Here’s what you can expect during the application process:

Step 1: Pre-Approval

Getting pre-approved is a great first step. It gives you an idea of how much you can borrow and shows sellers that you’re serious. To get pre-approved, you’ll need to provide financial information, such as your income, assets, and debts.

Step 2: Submitting Your Application

Once you’re ready to move forward, you’ll need to submit a full mortgage application. This involves providing detailed documentation, including tax returns, pay stubs, and bank statements. Don’t worry if it sounds overwhelming—Chase’s team will guide you through the process.

Step 3: Loan Approval

After reviewing your application, Chase will either approve or deny your loan. If approved, you’ll receive a loan estimate outlining the terms and conditions. Take the time to review this carefully before moving forward.

Chase Mortgage Rates: What to Expect

Mortgage rates can vary based on several factors, including the type of loan, your credit score, and current market conditions. Here’s a breakdown of what you might expect:

Fixed-Rate Mortgages

As of 2023, Chase’s fixed-rate mortgage rates typically range from 5% to 7%, depending on the loan term and your credit profile. Longer terms, like 30-year loans, usually come with higher rates than shorter terms, like 15-year loans.

Adjustable-Rate Mortgages

ARMs often start with lower rates than fixed-rate mortgages, but they can increase over time. Chase’s ARMs may start around 4% but could rise significantly after the initial fixed period ends.

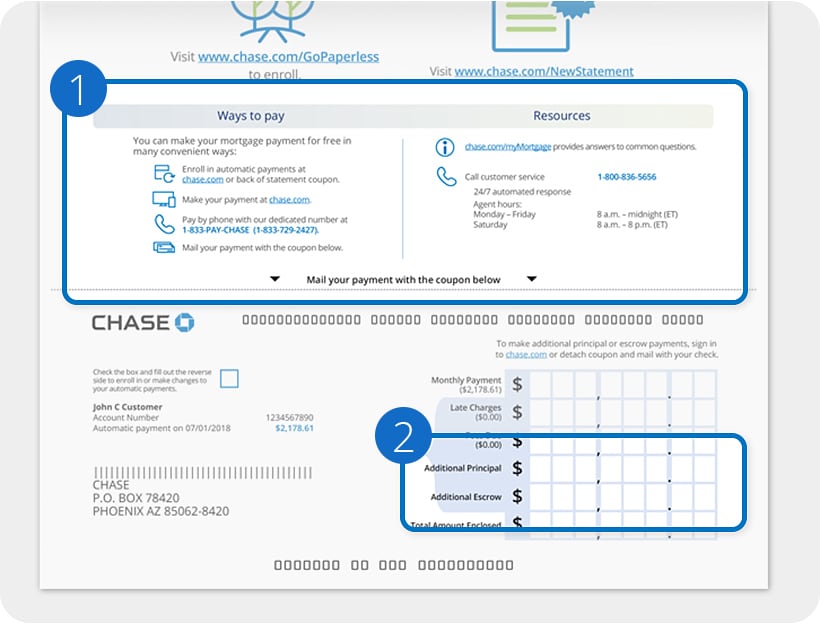

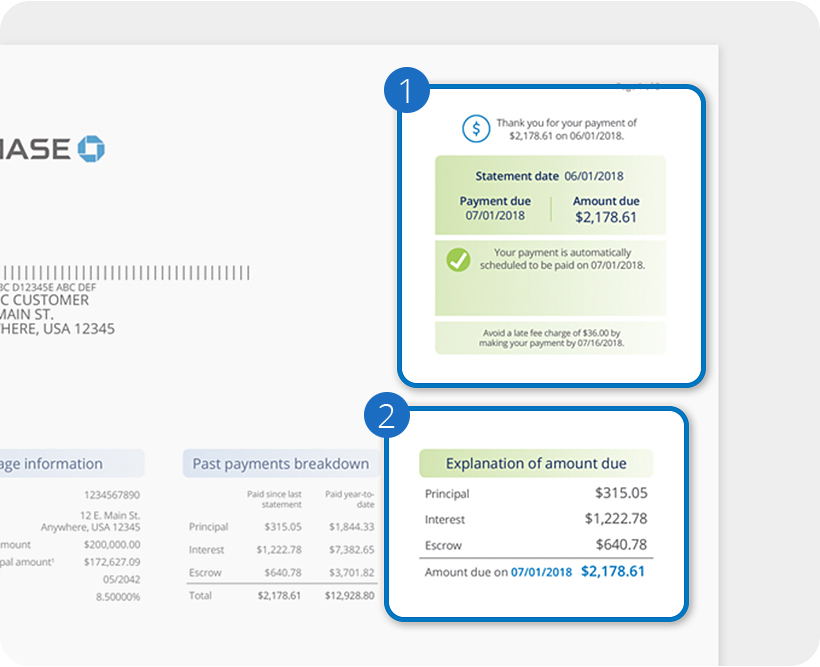

Chase Mortgage Calculator: Plan Your Payments

One of the best tools Chase offers is their mortgage calculator. This handy tool lets you estimate your monthly payments based on different scenarios. You can input variables like loan amount, interest rate, and term to see how they affect your payments.

Using the calculator is simple. Just visit Chase’s website, enter your information, and let the calculator do the math for you. It’s a great way to budget and ensure you’re comfortable with the payments before committing to a loan.

Refinancing with Chase Mortgage

Already have a mortgage? Refinancing with Chase could save you money. Whether you want to lower your interest rate, shorten your loan term, or cash out equity, Chase offers several refinancing options.

Benefits of Refinancing

- Lower monthly payments

- Reduced interest rates

- Shorter loan terms

- Cash-out options for home improvements

However, refinancing isn’t right for everyone. It’s important to weigh the costs and benefits before making a decision. Chase’s team can help you determine if refinancing is a good fit for your situation.

Chase Mortgage Customer Reviews

What do Chase Mortgage customers have to say? Reviews are mixed, but overall, most customers are satisfied with their experience. Many praise Chase for their competitive rates and excellent customer service. However, some have expressed frustration with the application process, citing delays and paperwork issues.

If you’re considering Chase Mortgage, it’s a good idea to read reviews from multiple sources to get a well-rounded perspective. Websites like Trustpilot and Google Reviews can be great resources.

Tips for a Successful Chase Mortgage Experience

Want to make the most of your Chase Mortgage experience? Here are a few tips:

Tip 1: Improve Your Credit Score

A higher credit score can lead to better rates and terms. Pay down debts, make payments on time, and avoid opening new credit accounts before applying.

Tip 2: Gather Your Documents Early

The application process goes smoother when you have all your documents ready. Start collecting things like tax returns, pay stubs, and bank statements well in advance.

Tip 3: Shop Around

While Chase Mortgage is a great option, it’s always a good idea to compare rates and terms with other lenders. This ensures you’re getting the best deal possible.

Conclusion: Is Chase Mortgage Right for You?

In conclusion, Chase Mortgage offers a wide range of options to help you achieve your homeownership dreams. From competitive rates to excellent customer support, they’ve got a lot to offer. But like any financial decision, it’s important to do your research and weigh the pros and cons.

So, what’s next? If you’re ready to explore Chase Mortgage further, visit their website or reach out to a mortgage specialist. And don’t forget to share this article with friends and family who might find it helpful. Together, we can all make smarter financial choices!

Table of Contents

- Understanding Chase Mortgage: The Basics

- Why Choose Chase Mortgage?

- Eligibility and Requirements

- Applying for a Chase Mortgage

- Chase Mortgage Rates: What to Expect

- Chase Mortgage Calculator: Plan Your Payments

- Refinancing with Chase Mortgage

- Chase Mortgage Customer Reviews

- Tips for a Successful Chase Mortgage Experience

- Conclusion: Is Chase Mortgage Right for You?