Are you ready to dive into the world of homeownership? If you're thinking about getting a mortgage, then understanding Chase mortgage preapproval is your first step toward securing that dream home. In today's competitive real estate market, having a preapproval letter can make all the difference. It's not just about showing sellers you're serious; it's about proving you're financially ready to close the deal. So, let's break down everything you need to know about Chase mortgage preapproval and how it can set you up for success.

Buying a home is one of the biggest financial decisions you'll ever make, and it's natural to feel overwhelmed. But don't worry, because Chase has got your back. With their mortgage preapproval process, they'll assess your financial situation, credit score, and income to give you a clear picture of what you can afford. It's like having a financial roadmap before you even start house hunting.

Now, here's the deal—getting preapproved isn't just about ticking off a box on your to-do list. It's about positioning yourself as a strong buyer in a market where time is money. Sellers love preapproved buyers because they know the financing is already in place. And let's be honest, who doesn't want that extra edge when bidding on a home? So, stick around as we explore the ins and outs of Chase mortgage preapproval and how it can work for you.

Read also:Wandering Toddler Unveils Home Mystery The Unbelievable Truth Behind The Little Explorer

Before we dive deeper, let's take a quick look at what we'll cover in this article:

- Understanding Chase Mortgage Preapproval

- Biography of Chase Mortgage

- Steps to Get Chase Mortgage Preapproval

- Requirements for Chase Mortgage Preapproval

- Benefits of Chase Mortgage Preapproval

- Common Mistakes to Avoid

- How Chase Mortgage Preapproval Works

- Comparison with Other Mortgage Lenders

- Tips for a Successful Preapproval

- Final Thoughts on Chase Mortgage Preapproval

Understanding Chase Mortgage Preapproval

Alright, let's get down to business. Chase mortgage preapproval is essentially a conditional approval from Chase Bank that indicates how much money they're willing to lend you for a home purchase. It's like a financial handshake that says, "Hey, we trust you can handle this loan." This process involves reviewing your financial history, credit score, and income to determine your borrowing capacity.

Here's the kicker: preapproval isn't the same as a mortgage commitment. It's more of a preliminary assessment that gives you an idea of what you can afford. But don't let that discourage you—it's still a powerful tool when you're shopping for homes. Sellers and real estate agents take preapproved buyers more seriously because they know the financing is already lined up.

Now, let's talk numbers. According to recent data, Chase Bank is one of the top lenders in the U.S., with billions of dollars in mortgage loans issued annually. Their preapproval process is designed to be efficient and user-friendly, ensuring you get the information you need quickly. Plus, Chase offers a variety of mortgage options, so whether you're a first-time buyer or a seasoned homeowner, they've got something for you.

Biography of Chase Mortgage

Before we jump into the nitty-gritty, let's take a moment to understand who Chase Mortgage really is. Founded in 1799, JPMorgan Chase & Co. has grown to become one of the largest financial institutions in the world. Chase Mortgage is part of this banking giant, offering a wide range of mortgage products tailored to meet the needs of different borrowers.

Read also:Bruce Willis Celebrates 70th Birthday Amid Dementia Battle

Data and Biodata of Chase Mortgage

| Founded | 1799 |

|---|---|

| Headquarters | New York City, USA |

| Annual Mortgage Loans | $100+ billion |

| Mortgage Products | Fixed-rate, adjustable-rate, FHA, VA, jumbo loans |

| Customer Base | Millions of homeowners across the U.S. |

Chase Mortgage has been a trusted name in the industry for decades, known for its reliability, transparency, and customer service. They consistently rank high in customer satisfaction surveys, which is why so many people turn to them for their home financing needs.

Steps to Get Chase Mortgage Preapproval

So, how do you actually get preapproved for a mortgage with Chase? It's simpler than you might think. Here's a step-by-step guide to help you navigate the process:

- Visit Chase's Website: Start by heading over to Chase's official website. They have a dedicated section for mortgage preapproval where you can begin the application process online.

- Provide Financial Information: You'll need to share details about your income, assets, debts, and credit history. Don't worry, Chase makes it easy to upload documents digitally.

- Submit Your Application: Once you've entered all the required information, submit your application. Chase typically reviews applications within a few business days.

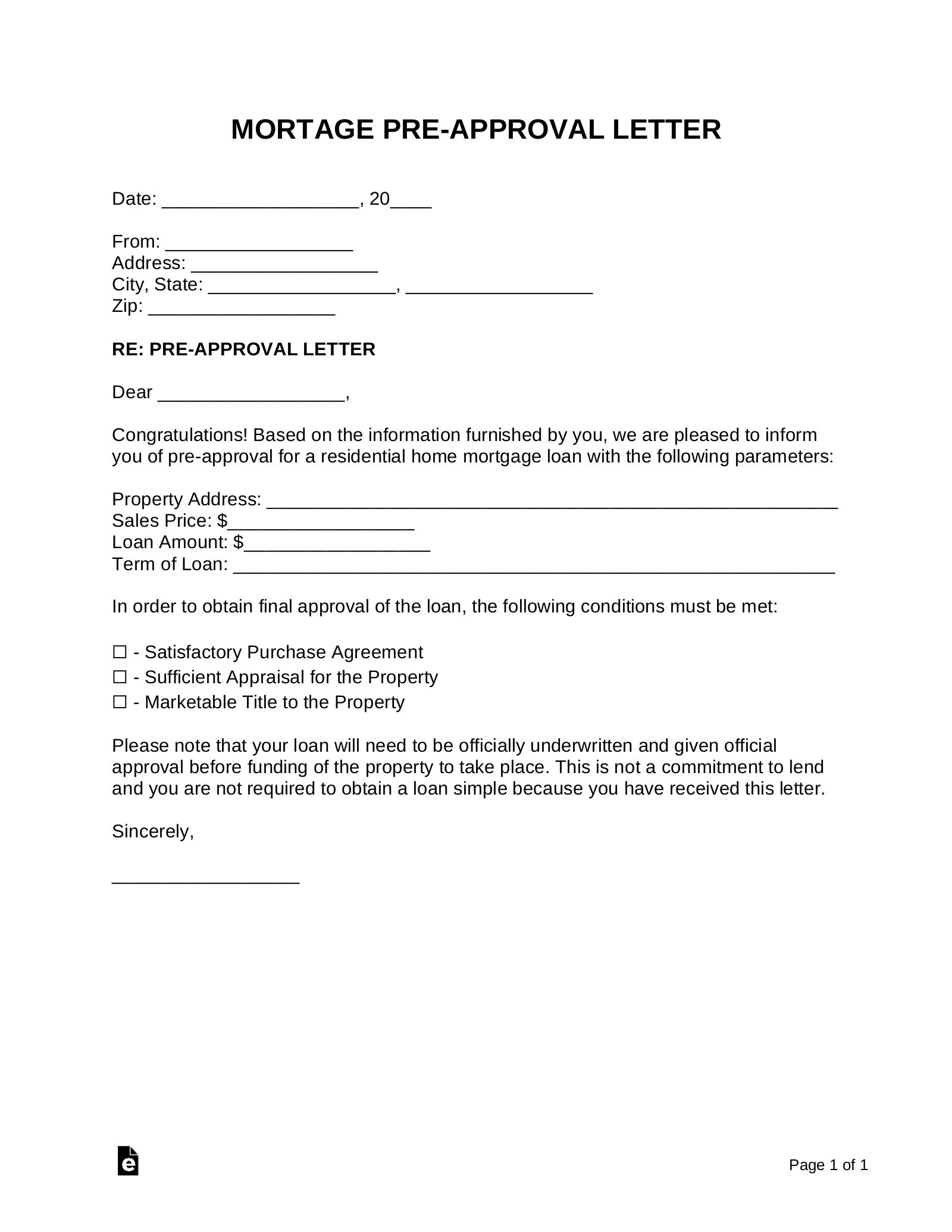

- Receive Your Preapproval Letter: If everything checks out, Chase will send you a preapproval letter that you can show to sellers and real estate agents.

Pro tip: Start gathering your financial documents early. Having everything ready will speed up the process and reduce stress. And hey, who doesn't love a stress-free experience?

Requirements for Chase Mortgage Preapproval

Now that you know the steps, let's talk about what Chase needs from you to grant preapproval. Here's a quick rundown of the requirements:

- Proof of income (pay stubs, W-2 forms, tax returns)

- Bank statements showing your savings and checking accounts

- Documentation of any assets, such as retirement accounts or investments

- Information about your current debts (credit cards, car loans, student loans)

- A credit score of at least 620 (although higher scores may qualify for better rates)

Remember, the more organized you are, the smoother the process will be. Chase wants to ensure you're a responsible borrower, so they'll thoroughly review all the information you provide.

Benefits of Chase Mortgage Preapproval

Why should you bother with Chase mortgage preapproval? Well, there are plenty of reasons. Here are just a few:

- Increased Buying Power: Knowing your budget upfront allows you to focus on homes that fit your financial situation.

- Competitive Edge: Sellers are more likely to accept offers from preapproved buyers because they know the financing is secure.

- Peace of Mind: Having a preapproval letter gives you confidence that you can afford the home you want.

- Locked-In Rates: Chase may offer rate locks, which means you can secure today's rates even if the market fluctuates.

These benefits add up to a smoother, less stressful home buying experience. Who wouldn't want that?

Common Mistakes to Avoid

As with any financial process, there are pitfalls to watch out for. Here are some common mistakes to avoid when applying for Chase mortgage preapproval:

- Not Checking Your Credit Score: Before you apply, make sure your credit score is in good shape. Disputing errors or paying down debt can improve your chances of approval.

- Overestimating Your Budget: Be realistic about what you can afford. Just because Chase approves you for a certain amount doesn't mean you have to spend that much.

- Missing Documentation: Double-check that you've provided all the required documents. Missing info can delay the process.

- Waiting Until the Last Minute: Start the preapproval process early so you're ready to act when you find the perfect home.

Avoiding these mistakes will save you time and hassle, allowing you to focus on finding your dream home.

How Chase Mortgage Preapproval Works

Let's break down the mechanics of Chase mortgage preapproval. When you apply, Chase's underwriters will analyze your financial profile to determine your borrowing capacity. They'll look at factors like:

- Your credit score and credit history

- Your debt-to-income ratio (DTI)

- Your employment history and income stability

- Your savings and assets

Based on this analysis, Chase will issue a preapproval letter that outlines the maximum loan amount they're willing to offer. This letter is valid for a certain period, usually 90 days, giving you time to find the right home.

Comparison with Other Mortgage Lenders

How does Chase stack up against other mortgage lenders? Here's a quick comparison:

| Feature | Chase Mortgage | Other Lenders |

|---|---|---|

| Loan Options | Wide variety, including fixed-rate, adjustable-rate, FHA, VA, and jumbo loans | Varies by lender |

| Preapproval Process | Efficient and user-friendly | Can be slower or more complex |

| Customer Service | Highly rated | Varies widely |

| Interest Rates | Competitive rates based on credit score | Depends on lender and market conditions |

While other lenders may offer similar products, Chase's reputation for reliability and customer service often gives them the edge.

Tips for a Successful Preapproval

Want to increase your chances of getting approved? Here are some tips to help you succeed:

- Pay down existing debt to improve your DTI ratio

- Boost your credit score by making timely payments and reducing credit utilization

- Save as much as possible for a down payment

- Be honest and transparent about your financial situation

By following these tips, you'll position yourself as a strong candidate for Chase mortgage preapproval.

Final Thoughts on Chase Mortgage Preapproval

Chase mortgage preapproval is a crucial step in the home buying process. It gives you the confidence and negotiating power you need to find and secure your dream home. By understanding the requirements, avoiding common mistakes, and following our tips, you'll be well on your way to a successful preapproval.

So, what are you waiting for? Take the first step toward homeownership today. Apply for Chase mortgage preapproval and start your journey to finding the perfect home. And don't forget to share this article with friends and family who might be in the market for a new home. Together, we can make the dream of homeownership a reality for everyone!

.png)